About Us

SOUTH ATLANTIC MICROFINANCE INSTITUTION

SOUTH ATLANTIC MFI is the money lending arm of South Atlantic EDM Investments Nigeria Ltd – a company incorporated with internet payment systems as a core competency. We are licensed by the Rivers State Government as a Money Lender.

In partnership with WirelessPay Uk, and AssetMatrix MFB we developed the unique South Atlantic Loan Management Software which integrates direct bank accounts through NIBSS, POS, Debit cards and SMS alerts. This technology has improved efficiency in our lending business; particularly in loan disbursements, repayments and savings collections. A repayment record of up to 92% was achieved in our last loan cycle. This scalable technology is a crucial factor in our next projections starting from Q3 of 2025.

Mission

To provide seamless financial solutions that enable citizens build resilience, create wealth and contribute to economic growth

Vision

To become the leading tech-driven microfinance institution in Nigeria

Core Value

- Trust

- Innovation

- Accountability

- Empathy

providing comprehensive financial solutions

At South Atlantic EDM Investments Ltd, we are dedicated to providing comprehensive financial solutions tailored to meet the diverse needs of our clients. With a strong commitment to excellence and innovation, we offer a range of services including finance for MSMEs, microfinance for agriculture, internet payment systems, real estate services, and agro-commodity marketing. Let’s dive into who we are and what we can do for you.

Problem Statement

- Most small businesses in Niger Delta lack financial literacy to contain emerging economic challenges

- Some lack Bank Verification Numbers (BVN) for proper onboarding

- Little access to formal banking in rural areas

- Gender bias in loan approvals in major banks

- Inadequate collaterals

- Prevalence of Loan sharks with harsh lending conditions

- 90% of MSMEs lack access to needed capital

Our Solution

- Our flagship ACTIVE WOMEN CLUSTERS PROGRAM provides financial literacy and business loans to enterprising women.

- We partner with licensed DIGITAL SPs to provide BVN and NIN registration services to rural dwellers of Rivers State and environs

- We provide gender-sensitive loan under easy payment terms and conditions

- Our interest rates are within industry standards

- We take banking to rural communities.

- We provide DIGITAL BANKING & FINTECH SOLUTIONS

Strategic Partnerships

ASSET MATRIX MICROFINANCE BANK

(licensed by the CBN - for faster bank transfer solutions)

ANMFIN

(an initiative of the CBN)- regulatory and supervisory support

SUCCESSORY NIGERIA LTD

for manpower development and staff –training

WIRELESS-PAY UK

for fintech/cloud based services

LAPO MICROFINANCE BANK

(licensed by the CBN)

Our Growth Plan

Client Growth:

Onboard 500 new clients monthly.

Digital Expansion:

Drive BVN and NIN registration to enhance financial inclusion

Regional Expansion:

Grow beyond Rivers State into underserved regions of Nigeria.

Staff Training:

Organize 6 monthly professional training for all staff

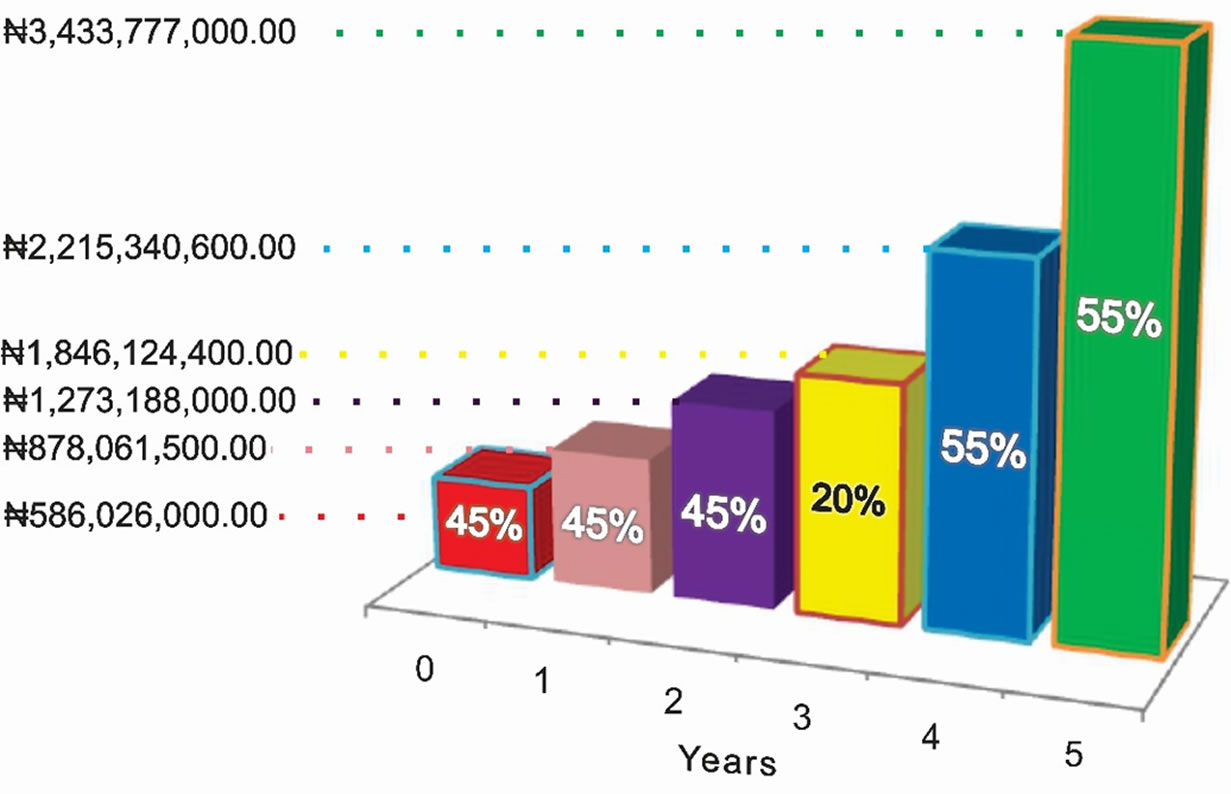

Equity Capital requirement for 5 Years NGN586,026,000.00

REVENUE PROJECTION

Upwards of 45% is projected as ROI from the 1st year. Nevertheless, we forecast a dip in revenue on the 3rd year due to capital expenditure on branches, and staff training. But afterwards, there is a clear leap from 20% to 55% ROI on the 4th and 5th year resulting in a total revenue approaching NGN3.5 Billion by the last quarter of the 5th year.

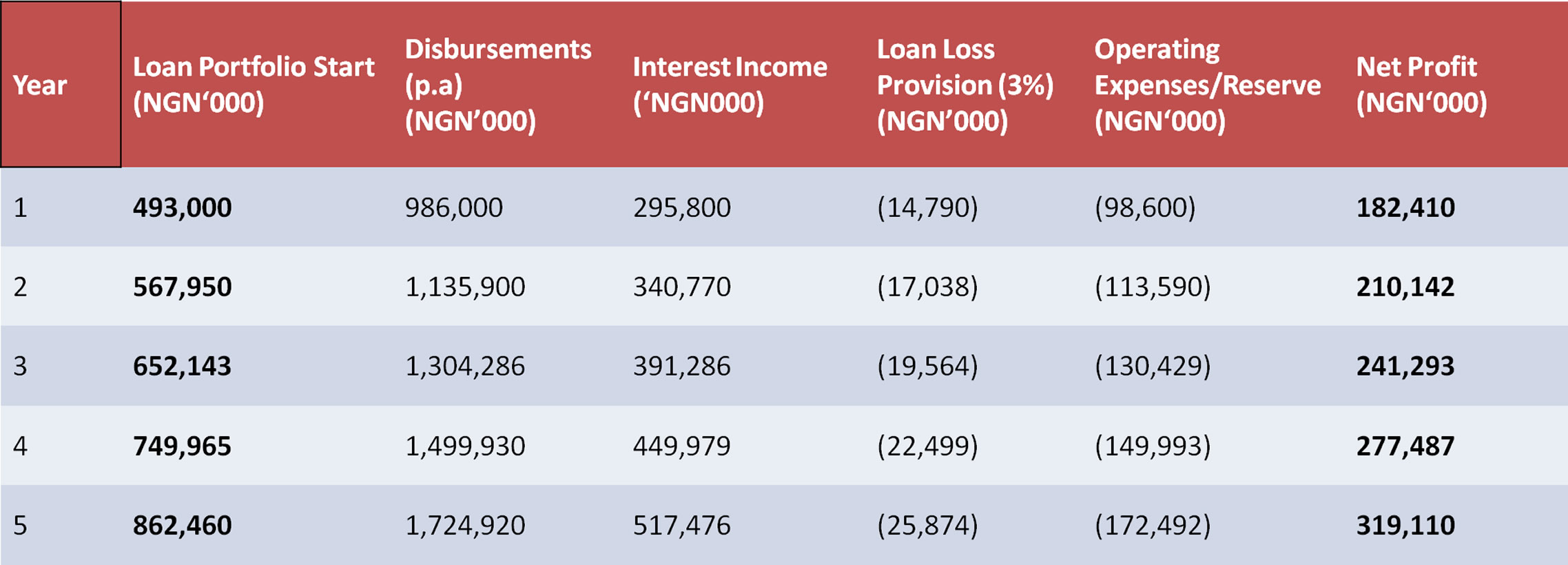

5-Year Financial Projection

PROJECTIONS ARE BASED ON THE KEY ASSUMPTIONS BELOW:

- Initial capital NGN580,000,000

- Interest on loan (30%)

- Annual portfolio growth 15%

- Loan portfolio 85% (NGN493,000,000)

- Operating cost/Reserve fund 15% (NGN98,600)

- Repayment rate 97%

- Default rate 3%

- Portfolio turnover (every 6 months)

Wanted: Partners For Equity

As a growing Fintech in the Niger Delta, the demands for our services are increasing; and so do opportunities to impact lives and make profit. Therefore, we urgently need:

PARTNERS, to provide:

- Technical aid and personnel training.

- Capital for expansion (as equity or debt).

- Funds for on-lending to loan applicants and beneficiaries.

- Financial support to meet regulatory compliance SEC/CBN.

- Online infrastructure for 100% cloud presence, and data security.

Note:

We offer 30% equity, plus Board membership to eligible Investors, Corporate bodies or Venture Capitalists who can provide some of the above. The Board membership serves as comfort for the investor who may wish to oversee the deployment and safety of provided funds.